The City’s Case against Transparency 1

I wrote the following article for the Evening Standard on 23 February. Here is part of the City’s case, referred to in the article, for not supporting the promotion of transparency in the Overseas Territories and Crown Dependencies.

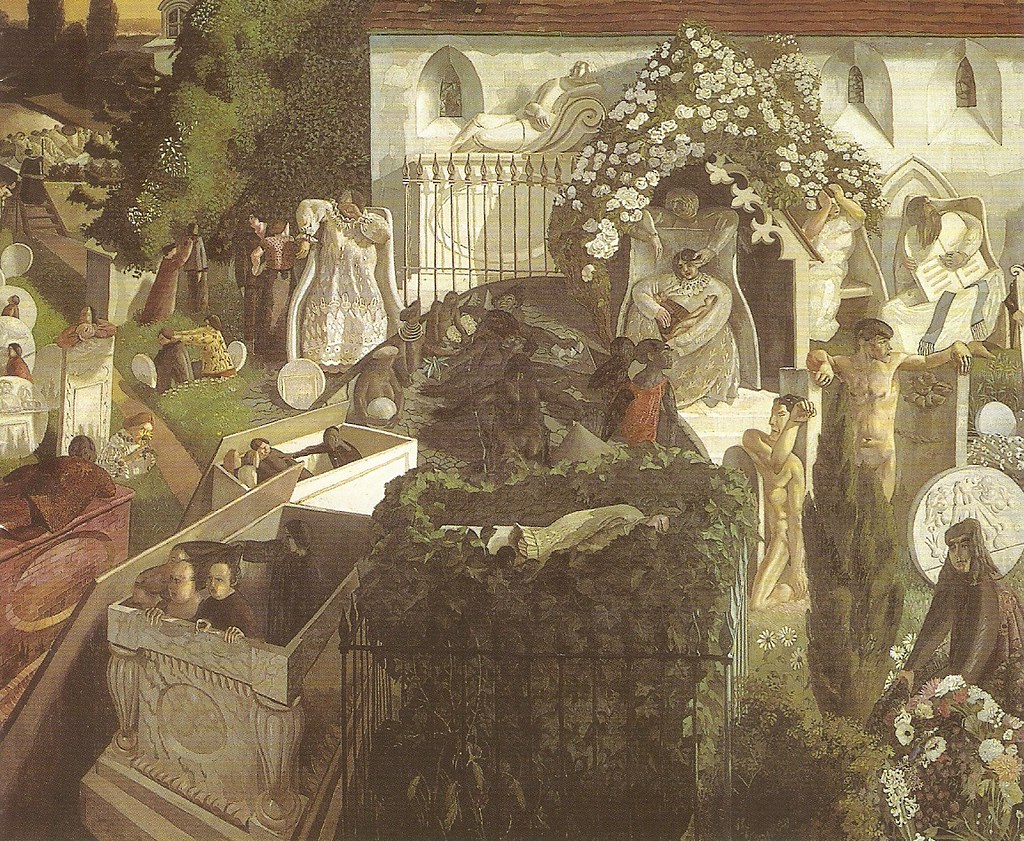

Death and taxes: the two things you can be sure of in life. As a vicar, I expect to have to deal with death. But taxes?

I have recently been taking quite an interest in taxes too. Earlier this year we discovered that HSBC had been involved in designing and promoting illegal tax avoidance products for its richest clients.

The Prime Minister blustered that the illegal activity had taken place under a Labour government. The Leader of the Opposition duly wagged his finger back. HSBC’s chairman at the time, Lord Green, stepped down as chair of the advisory committee for City lobby group TheCityUk.

In fact, this story has been rumbling on since 2013, when in his G8 Presidency year David Cameron promised his fellow leaders that he would get his own tax avoidance house in order. Among other measures he told the British Overseas Territories and Crown Dependencies to publish their registers of beneficial ownership in order to bring some daylight to the deals going on in these secrecy jurisdictions, or “tax havens” as they are more typically known. They still haven’t done so.

But much as we can huff and puff, don’t the current arrangements really rather suit us — or some of us? This is the central contention of Mark Donne’s film, The UK Gold, which got an airing on television last week.

In it, he does a power analysis of the overlapping institutions involved with one another to keep tax secrecy in place. With 98 of the FTSE 100 companies routinely using recognised tax havens, Donne makes the case that we have actually constructed our political economy around the continuing importance of these secrecy jurisdictions.

One key institution is the City of London Corporation, the ancient body that governs the Square Mile. This is where I come in. The film follows me as I stood for election to the City in 2013.

I stood in the ward where one of my parishioners worked. He shared an office with some of the highest-paid tax lawyers and asset managers in the Square Mile. He was their cleaner.

I stood because I wanted to know how one of London’s lowest-paid workers is represented within this system. Does it serve him too? Does it serve the rest of us?

Recently I went along to the offices of TheCityUK to hear its policy on the role of these secrecy jurisdictions. I was told by its director of policy that it had no policy. He told me that it was not something any of their members had ever really bothered about. He said it had never come across their radar.

A few days later I received a slightly more helpful briefing paper from the head of city affairs at the City Corporation stating that, in his view, increased openness would impose debilitating “administration and compliance costs” and transparency could “inhibit the flow of capital . . . putting jobs and tax revenue at stake”. In other words: not keen.

My conclusion is this: either we continue to pretend that these secrecy jurisdictions aren’t at the heart of our corporate tax policy in this country, or we begin to have an honest evaluation of their role.

Previous Post

Previous Post Next Post

Next Post